Finance Director's review

Strong progress in difficult conditions

The Group delivered a strong increase in underlying revenues and improved profits. The published results were heavily influenced by the significant adjustments in foreign exchange rates in 2008.

The progress made by the Group in 2008 should be viewed against a rapidly deteriorating external environment with significant negative pressures starting to influence many industries and companies.

The Group delivered a strong 17 per cent increase in underlying revenues, a ten per cent increase in underlying profit before tax to £880 million and a further £570 million cash inflow which benefited from retranslation effects. The strong improvement in profits was achieved despite some significant headwinds, notably a further eight cents deterioration in the GBP/USD achieved rate that cost the Group £104 million in 2008; and there was a four per cent increase in unit costs.

The published results were heavily influenced by the significant adjustments in foreign exchange rates in 2008, especially the GBP/USD and the GBP/EUR which are explained below.

The Group benefited from a strong financial position and credit rating with net cash of £1,458 million at the year end and with average net cash throughout the year of £375 million. The changes made to the Group's UK pension schemes in 2007 mean that the deficit has remained stable and modest and the schemes ended the year with a net deficit of £142 million, as detailed in note 18 of the financial statements on page Post-retirement benefits. The very unusual circumstances that have developed through 2008 in global debt markets have, however, caused a large, unrecognised surplus to develop on the UK defined benefit pension schemes.

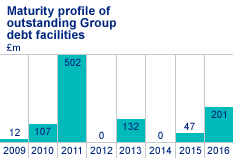

The redemptions on the Group's existing bond financing, at around £1.0 billion, are well spread with no material maturities in 2009, US$187 million due in the second half of 2010 and a €750 million note due in 2011 as shown in the chart below. The Group had a further £650 million in term funding available to it that was undrawn at the year end.

Foreign exchange effects on published results

The pace and extent of currency movements have had a significant effect on the Group's financial reporting in 2008,with the sterling exchange rate with the US dollar and the euro having the biggest impact. These movements have influenced both the reported income statement and the cash flow and closing net cash position, (as set out in note 2 and the cash flow statement in the financial statements), in the following ways:

1. Income statement – the most important impact was the end of year mark to market of outstanding financial instruments (foreign exchange contracts, interest rate, commodity and jet fuel swaps). The principal adjustments related to the GBP/USD hedge book.

The principal movements in 2008 were as follows:

| Open | Close | |

| GBP – USD | £1 – $1.991 | £1 – $1.438 |

| GBP – EUR | £1 – €1.362 | £1 – €1.034 |

| Oil – Spot Brent | $93/bbl | $49/bbl |

The impact of this mark to market is included in net financing in the income statement and caused a net £2.5 billion cost, contributing to a published loss before tax of £1,892 million. These adjustments are non-cash, accounting adjustments required under IAS39 Financial Instruments: Recognition and Measurement. As a result, reported earnings do not reflect the economic substance of derivatives that have been settled in the financial year, but do include the unrealised gains and losses on derivatives that will only affect cash flows when they are settled at some point in the future to match trading cash flows.

Underlying earnings are presented on a basis that shows the economic substance of the Group’s hedging strategies in respect of transactional exchange rates and commodity price movements. Further details and information are included within the section on key performance indicators on page Key performance indicators and in notes 2 and 5 of the financial statements.

The achieved rate on selling net US dollar income will be similar in 2009 to that in 2008 and will gradually improve thereafter as the Group is able to absorb the lower value of sterling in its hedge books into the achieved rate. The revaluation costs, which are measured at a point in time, do not, therefore, represent additional currency headwinds. The improving average rate in the hedge book will lead to improving achieved rates over time.

2. Cash flow and balance sheet – the Group maintains a number of currency cash balances which vary throughout the financial year. Given the significant movements in foreign exchange rates in 2008, a number of these cash balances were inflated by the effects of retranslation at the year end, causing an increase of £439 million in the 2008 cash flow and hence the closing balance sheet cash position.

The Group's revenues increased by 22 per cent in 2008 to £9,082 million with 84 per cent of revenues from customers outside the UK.

- Underlying growth of 11 per cent in civil aerospace revenues was supported by strong growth from original equipment with 987 engines delivered in the year, a 16 per cent increase over 2007, and growth across all sectors –widebody, narrowbody and corporate and regional. Services revenues increased by seven per cent over 2007.

- Underlying defence aerospace revenues were similar to 2007 with new equipment revenues down seven per cent and services revenues increasing by eight per cent over 2007.

- The marine business continued to grow rapidly in 2008 with underlying revenues increasing 42 per cent from 2007 to £2,204 million, driven by strong demand for product and support in the offshore oil and gas sector. Overall new equipment revenues increased by 49 per cent to £1,492 million with services revenues increasing 31 per cent to £712 million.

- The energy business made good progress in the year with underlying revenues up 35 per cent, supported by good growth in both original equipment and services activities.

Overall underlying services revenues increased by 11 per cent in 2008 to £4,755 million and accounted for 52 per cent of Group revenues for the year.

Underlying profit margins before financing costs reduced slightly from 10.6 per cent in 2007 to ten per cent in 2008. The reduction in margin was the result of an increased proportion of original equipment to service revenues, increased unit costs and further headwinds on foreign exchange. These were partially offset by the benefits of increased volumes, improving productivity and cost reduction activity. Underlying financing costs remained relatively stable at £39 million (2007 £32 million) including net interest of £10 million and finance costs associated with financial risk and revenue sharing partnerships.

Restructuring charges in 2008 increased to £82 million (2007 £52 million) as the Group continued its focus on operational improvements, including the reduction in the number of people working in support functions. These costs are included within operating costs.

A final payment to shareholders of 8.58p per share, in the form of C Shares, is proposed, making a total of 14.30p per share, a ten per cent increase over the 2007 total.

The order book at December 31, 2008, at constant exchange rates, was £55.5 billion (2007 £45.9 billion) with strong growth across all divisions.

This included firm business that had been announced but for which contracts had not yet been signed of £6.1 billion (2007 £7.1 billion).

In civil aerospace, it is common for a customer to take options for future orders in addition to firm orders placed. Such options are excluded from the order book.

In defence aerospace, long-term programmes are often ordered for only one year at a time. In such circumstances, even though there may be no alternative engine choice available to the customer, only the contracted business is included in the order book.

Aftermarket services agreements, including TotalCare packages, represented 26 per cent of the order book, having increased by £1.4 billion in the year. These are long-term contracts where only the first seven year’s revenue is included in the order book.

The Group continues to be successful in developing its aftermarket services activities. These grew by 11 per cent on an underlying basis in 2008 and accounted for 52 per cent of Group revenue.

In particular, TotalCare packages in the civil aerospace sector now over 57 per cent, by value, of the installed fleet. TotalCare packages cover long-term management of the maintenance and associated logistics for our engines and systems, monitoring the equipment in service to deliver the system availability our customers require with predictable costs. The pricing of such contracts reflects their long-term nature. Revenues and costs are recognised based on the stage of completion of the contract, generally measured by reference to flying hours. The overall net position of assets and liabilities on the balance sheet for TotalCare packages was an asset of £848 million (2007 £550 million).

Cash inflow during the year was £570 million (2007 £562 million, before the special injection of £500 million into the UK pension schemes). Continued growth in underlying profits and good cash conversion were supported by increases in customer deposits and progress payments of £400 million and the benefit of £439 million from year-end currency revaluations.

Working capital increased by £38 million during the year with increased inventory of £208 million, offset by reduced financial working capital of £170 million. Inventory increased in the year to support growth across all businesses and to minimise disruption during the transition to new operational facilities. Some reductions in deposits are expected in 2009.

Cash investments of £675 million in property, plant and equipment and intangible assets and payments to shareholders of £200 million represented the major cash outflows in the period. Tax payments increased in the year to £117 million (2007 £71 million).

As a consequence average net cash was £375 million (2007 £350 million). The net cash balance at the year end was £1,458 million (2007 £888 million).

The overall tax credit on the loss before tax was £547 million (2007 £133 million charge), a rate of 28.9 per cent (2007 18.1 per cent). The tax credit in 2008 mainly reflects the loss caused by the mark to market of outstanding financial instruments at the year end.

The tax charge on underlying profit was £217 million (2007 £193 million) a rate of 24.7 per cent (2007 24.1 per cent).

The overall tax credit was increased by £25 million in respect of the expected benefit of the UK research and development tax credit. This reduced the underlying tax charge by the same amount. In addition, £11 million of provisions for prior year's tax liabilities were written back following settlement of a number of outstanding tax issues. The underlying tax rate is expected to increase to around 26 per cent.

The operation of most tax systems, including the availability of specific tax deductions, means that there is often a delay between the Group tax charge and the related tax payments, to the benefit of cash flow.

The Group operates internationally and is subject to tax in many differing jurisdictions. As a consequence, the Group is routinely subject to tax audits and examinations which, by their nature, can take a considerable period to conclude. Provision is made for known issues based on management's interpretation of country specific legislation and the likely outcome of negotiation or litigation.

The Group believes that it has a duty to shareholders to seek to minimise its tax burden but to do so in a manner which is consistent with its commercial objectives and meets its legal obligations and ethical standards. While every effort is made to maximise the tax efficiency of its business transactions, the Group does not use artificial structures in its tax planning. The Group has regard for the intention of the legislation concerned rather than just the wording itself. The Group is committed to building open relationships with tax authorities and to following a policy of full disclosure in order to effect the timely settlement of its tax affairs and to remove uncertainty in its business transactions. Where appropriate, the Group enters into consultation with tax authorities to help shape proposed legislation and future tax policy.

Transactions between Rolls-Royce subsidiaries and associates in different jurisdictions are conducted on an arms-length basis and priced as if the transactions were between unrelated entities, in compliance with the OECD Model Tax Convention and the laws of the relevant jurisdictions.

Before entering into a transaction the Group makes every effort to determine the tax effect of that transaction with as much certainty as possible. To the extent that advance rulings and clearances are available from tax authorities, in areas of uncertainty, the Group will seek to obtain them and adhere to their terms.

The charges for pensions are calculated in accordance with the requirements of IAS 19 Employee Benefits.

The decision by the trustees of each of the principal UK defined benefit schemes, in consultation with the Group, to adopt a lower risk investment strategy during 2007 has served its members and the Group well during 2008. The combination of:

- reducing the overall UK pensions asset allocation to equities from approximately 80 per cent to 20 per cent;

- hedging the majority of interest rate and inflation risks associated with the pension liabilities, using swap contracts backed by short-term money market assets; and

- an incremental £500 million cash contribution from the Group to the main UK defined benefit schemes in 2007,

has significantly reduced volatility and losses as equity prices and interest rates have fallen.

Reducing the volatility of the pension schemes is the primary objective of the revised investment strategy to enable the trustees and the Group to plan a schedule of more stable contributions with greater confidence of the schemes being fully funded in the future.

Further information and details of the pensions’ charge and the defined benefit schemes’ assets and liabilities are shown in note 18 to the financial statements. The net deficit, after taking account of deferred tax, was £93 million (2007 £88 million). Changes in this net position are affected by the assumptions made in valuing the liabilities and the market performance of the assets.

The Group continues to subject all investments to rigorous examination of risks and future cash flows to ensure that they create shareholder value. All major investments require Board approval.

The Group has a portfolio of projects at different stages of their life cycles. Discounted cash flow analysis of the remaining life of projects is performed on a regular basis. Sales of engines in production are assessed against criteria in the original development programme to ensure that overall value is enhanced.

Gross research and development investment amounted to £885 million (2007 £824 million). Net research and development charged to the income statement was £403 million (2007 £381 million). The level of self-funded investment in research and development is expected to remain at approximately five per cent of Group sales in the future. The impact of this investment on the income statement will reflect the mix and maturity of individual development programmes and will result in a similar level of net research and development charged within the income statement in 2009.

The continued development and replacement of operational facilities contributed to the total investment in property, plant and equipment of £283 million (2007 £304 million). Investment in 2009 is anticipated to be slightly reduced from the 2008 level as the investments in new facilities in the US and Singapore are rephased to reflect the timing of major new airframe programmes.

Investment in training was £30 million (2007 £30 million).

The Group carried forward £2,286 million (2007 £1,761 million) of intangible assets. This comprised purchased goodwill of £1,008 million, engine certification costs and participation fees of £403 million, development expenditure of £456 million, recoverable engine costs of £213 million and other intangible assets of £206 million.

Expenditure on intangible assets is expected to increase modestly in 2009.

The development of effective partnerships continues to be a key feature of the Group's long-term strategy. Major partnerships are of two types: joint ventures and risk and revenue sharing partnerships.

Joint ventures are an integral part of our business. They are involved in engineering, manufacturing, repair and overhaul, and financial services. They are also common business structures for companies participating in international, collaborative defence projects.

They share risk and investment, bring expertise and access to markets, and provide external objectivity. Some of our joint ventures have become substantial businesses. A major proportion of the debt of the joint ventures is secured on the assets of the respective companies and is non-recourse to the Group.

Risk and revenue sharing partnerships (RRSPs)

RRSPs have enabled the Group to build a broad portfolio of engines, there by reducing the exposure of the business to individual product risk. The primary financial benefit is a reduction of the burden of research and development (R&D) expenditure on new programmes.

The related R&D expenditure is expensed through the income statement and the initial programme receipts from partners, which reimburse the Group for past R&D expenditure, are also recorded in the income statement, as other operating income.

RRSP agreements are a standard form of co-operation in the civil aero-engine industry. They bring benefits to the engine manufacturer and the partner. Specifically, for the engine manufacturer they bring some or all of the following benefits: additional financial and engineering resource; sharing of risk; and initial programme contribution. As appropriate, the partner also supplies components and as consideration for these components, receives a share of the long-term revenues generated by the engine programme in proportion to its purchased programme share.

The sharing of risk is fundamental to RRSP agreements. Partners share financial investment in the programme, in general they share:

- market risk as they receive their return from future sales;

- currency risk as their returns are denominated in US dollars;

- sales financing obligations;

- warranty costs; and

- where they are manufacturing or development partners, technical and cost risk.

Partners that do not undertake development work or supply components are referred to as financial RRSPs and are accounted for as financial instruments as described in the accounting policies on notes to the consolidated financial statements.

In 2008, the Group received other operating income of £79 million (2007 £50 million).

Payments to RRSPs are recorded within cost of sales and increase as the related programme sales increase. These payments amounted to £268 million (2007 £199 million).

The classification of financial RRSPs as financial instruments has resulted in a liability of £455 million (2007 £315 million) being recorded in the balance sheet and an associated underlying financing cost of £26 million (2007 £26 million) recorded in the income statement.

In the past, the Group has also received government launch investment in respect of certain programmes. The treatment of this investment is similar to non-financial RRSPs.

The Board has an established, structured approach to risk management. The risk committee (see board committees) has accountability for the system of risk management and reporting the key risks and associated mitigating actions. The Director of Risk reports to the Finance Director. The Group's policy is to preserve the resources upon which its continuing reputation, viability and profitability are built, to enable the corporate objectives to be achieved through the operation of the Rolls-Royce business processes. Risks are formally identified and recorded in a corporate risk register and its subsidiary registers within the businesses, which are reviewed and updated on a regular basis, with risk mitigation plans identified for significant risks.

The Group uses various financial instruments in order to manage the exposures that arise from its business operations as a result of movements in financial markets. All treasury activities are focused on the management and hedging of risk. It is the Group's policy not to trade financial instruments or to engage in speculative financial transactions. There have been no significant changes in the Group's policies in the last year.

The principal economic and market risks continue to be movements in foreign currency exchange rates, interest rates and commodity prices. The Board regularly reviews the Group's exposures and financial risk management and a specialist committee also considers these in detail.

All such exposures are managed by the Group Treasury function, which reports to the Finance Director and which operates within written policies approved by the Board and within the internal control framework described on the page Internal control and riskmanagement.

The Group has an established policy for managing counterparty credit risk. A common framework exists to measure, report and control exposures to counterparties across the Group using value-at-risk and fair-value techniques. The Group assigns an internal credit rating to each counterparty, which is assessed with reference to publicly available credit information, such as that provided by Moody's, Standard & Poor's, and other recognised market sources, and is reviewed regularly.

Financial instruments are only transacted with counterparties that have a publicly assigned long-term credit rating from Standard & Poor's of 'A-' or better and from Moody's of 'A3' or better.

The Group finances its operations through a mixture of shareholders' funds, bank borrowings, bonds, notes and finance leases. The Group borrows in the major global markets in a range of currencies and employs derivatives where appropriate to generate the desired currency and interest rate profile.

The Group's objective is to hold financial investments and maintain undrawn committed facilities at a level sufficient to ensure that the Group has available funds to meet its medium-term capital and funding obligations and to meet any unforeseen obligations and opportunities. The Group holds cash and short-term investments which, together with the undrawn committed facilities, enable it to manage its liquidity risk.

Short-term investments are generally held as bank deposits or in 'AAA' rated money market funds. The Group operates a conservative investment policy which limits investments to high quality instruments with a short-term credit rating of 'A-1' from Standard & Poor's or better and 'P-1' from Moody's. Counterparty diversification is achieved with suitable risk adjusted concentration limits. Investment decisions are refined through a system of monitoring real-time equity and credit-default swap (CDS) price movements of potential investment counter parties which are compared to other relevant benchmark indices and then risk-weighted accordingly.

During 2008, the Group did not experience any capital losses relating to its investments as a result of the credit crisis.

The Group increased its borrowing facilities during 2008 with the addition of a new £200 million loan facility from the European Investment Bank (EIB) relating to research and development. As at December 31, 2008 the Group had total committed borrowing facilities of £1.7 billion (2007 £1.5 billion). There are no material debt facility maturities until 2011. The maturity profile of the borrowing facilities is staggered to ensure that refinancing levels are manageable in the context of the business and market conditions.

There are no rating triggers contained in any of the Group's facilities that could require the Group to accelerate or repay any facility for a given movement in the Group's credit rating.

The Group's £250 million bank revolving credit facility contains a rating price grid, which determines the borrowing margin for a given credit rating. The Group's current borrowing margin would be 20 basic points (bp) over sterling LIBOR if drawn. The borrowing margin on this facility increases by approximately 5bp per one notch rating downgrade, up to a maximum borrowing margin of 55bp. The facility was not drawn during 2008.

There are no rating price grids contained in the Group's other borrowing facilities.

The Group continues to have access to all the major global debt markets.

The Group subscribes to both Moody's Investors Service and Standard & Poor's for its official publicised credit ratings. As at December 31, 2008 the Group's assigned long-term credit ratings were:

| Rating agency | Rating | Outlook | Category |

| Moody’s | A3 | Stable | Investment grade |

| Standard & Poor’s | A- | Stable | Investment grade |

As a long-term business, the Group attaches significant importance to maintaining an investment grade credit rating, which it views as necessary for the business to operate effectively.

The Group's objective is to maintain an 'A' category investment grade credit rating from both agencies.

The Group is exposed to movements in exchange rates for both foreign currency transactions and the translation of net assets and income statements of foreign subsidiaries.

The Group regards its interests in overseas subsidiary companies as long-term investments and manages its translational exposures through the currency matching of assets and liabilities where applicable. The matching is reviewed regularly, with appropriate risk mitigation performed where material mismatches arise.

The Group is exposed to a number of foreign currencies. The most significant transactional currency exposures are US dollars to sterling and US dollars to euros.

The Group manages its exposure to movements in exchange rates at two levels:

- Revenues and costs are currency matched where it is economic to do so. The Group actively seeks to source suppliers with the relevant currency cost base to avoid the risk or to flow down the risk to those suppliers that are capable of managing it. Currency risk is also a prime consideration when deciding where to locate new facilities. US dollar income converted into sterling represented 26 per cent of Group revenues in 2008 (2007 25 per cent). US dollar income converted into euros represented four per cent of Group revenues in 2008 (2007 four per cent).

- Residual currency exposure is hedged via the financial markets. The Group operates a hedging policy using a variety of financial instruments with the objective of minimising the impact of fluctuations in exchange rates on future transactions and cash flows.

Market exchange rates

| 2008 | 2009 | ||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

The permitted range of the amount of cover taken is determined by the written policies set by the Board, based on known and forecast income levels.

The forward cover is managed within the parameters of these policies in order to achieve the Group's objectives, having regard to the Group's view of long-term exchange rates. Forward cover is in the form of standard foreign exchange contracts and instruments on which the exchange rates achieved are dependent on future interest rates. The Group may also write currency options against a portion of the unhedged dollar income at a rate which is consistent with the Group's long-term target rate. At the end of 2008 the Group had US$17.1 billion of forward cover (2007 US$9.4 billion).

The consequence of this policy has been to maintain relatively stable long-term foreign exchange rates. Note 16 to the financial statements includes the impact of revaluing forward currency contracts at market values on December 31, 2008, showing a negative value of £2,181 million (2007 positive value of £379 million) which will fluctuate with exchange rates over time. The Group has entered into these forward contracts as part of the hedging policy, described above, in order to mitigate the impact of volatile exchange rates.

The Group uses fixed rate bonds and floating rate debt as funding sources. The Group's policy is to maintain a proportion of its debt at fixed rates of interest having regard to the prevailing interest rate outlook. To implement this policy the Group may utilise a combination of interest rate swaps, forward-rate agreements and interest-rate caps to manage the exposure.

The Group has an ongoing exposure to the price of jet fuel and base metals arising from business operations. The Group's objective is to minimise the impact of price fluctuations. The exposure is hedged, on a similar basis to that adopted for currency risks, in accordance with parameters contained in written policies set by the Board.

In connection with the sale of its products, the Group will, on some occasions, provide financing support for its customers. This may involve the Group guaranteeing financing for customers, providing asset-value guarantees (AVGs) on aircraft for a proportion of their expected future value, or entering into leasing transactions.

The Group manages and monitors its sales finance related exposures to customers and products within written policies approved by the Board and within the internal framework described in the corporate governance section. The contingent liabilities represent the maximum discounted aggregate gross and net exposure that the Group has in respect of delivered aircraft, regardless of the point in time at which such exposures may arise.

The Group uses Ascend Worldwide Limited as an independent appraiser to value its security portfolio at both the half year and year end. Ascend provides specific values (both current and forecast future values) for each asset in the security portfolio. These values are then used to assess the Group’s net exposure.

The permitted levels of gross and net exposure are limited in aggregate, by counterparty, by product type and by calendar year. The Group’s gross exposures were divided approximately 55:45 between AVGs and credit guarantees in 2008 (2007 55:45). They are spread over many years and relate to a number of customers and a broad product portfolio.

The Board regularly reviews the Group’s sales finance related exposures and risk management activities. Each financing commitment is subject to a credit and asset review process and prior approval in accordance with Board delegations of authority.

The Group operates a sophisticated risk-pricing model to assess risk and exposure.

Costs and exposures associated with providing financing support are incorporated in any decision to secure new business.

The Group seeks to minimise the level of exposure from sales finance commitments by:

- the use of third-party non-recourse debt where appropriate;

- the transfer, sale, or reinsurance of risks; and

- ensuring the proportionate flow down of risk and exposure to relevant RRSPs.

Each of the above forms an active part of the Group’s exposure management process. Where exposures arise, the strategy has been, and continues to be, to assume where possible liquid forms of financing commitment that may be sold or transferred to third parties when the opportunity arises.

Note 23 to the financial statements describes the Group’s contingent liabilities. There were no material changes to the Group’s gross and net contingent liabilities during 2008.

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the EU. No standards or interpretations that become effective during 2008 had a significant impact on the Group’s financial statements.

A summary of other changes, which have not been adopted in 2008, is included within the accounting policies in note 1 to the financial statements.

During the year the Company’s share price decreased by 39 per cent from 546p to 335.5p, compared to a 28 per cent decrease in the aerospace and defence sector and a 31 per cent decrease in the FTSE100. The Company’s shares ranged in price from 547p in January to 249p in October.

The number of ordinary shares in issue at the end of the year was 1,844 million, an increase of 24 million of which 12 million related to share options and 12 million related to conversion of B Shares into ordinary shares.

The average number of ordinary shares in issue was 1,820 million (2007 1,800 million).

Andrew Shilston

Finance Director

February 11, 2009