Services

- Service revenues increased by 11 per cent to £4.8 billion

- 57 per cent of the civil aerospace fleet now under TotalCare support

- More than 8,000 engines and auxiliary power units covered by in-service monitoring

- Expansion of joint ventures in Hong Kong and Singapore

- Global repair services created, increasing focus on repair technology

- Expanded capability of global Operation Centres, including satellite sites with two major customers

| Key performance indicators | 2008 | 2007 | 2006 | 2005 | 2004 |

| Underlying services revenue £m | 4,755 | 4,265 | 3,901 | 3,457 | 3,251 |

| Underlying services as percentage of Group revenue |

52 | 55 | 53 | 54 | 55 |

The Group’s services business includes field services, the sale of spare parts, equipment overhaul services, parts repair, data management, equipment leasing and inventory management services. These services are typically sold as a package under our TotalCare banner.

Group service revenues increased by 11 per cent in 2008, driven by good progress across all sectors. Services represented 52 per cent of Group revenues. The strongest growth was recorded in marine, demonstrating the value of expanding our service network in this sector. Our latest service centre in Mumbai was opened in May and later in the year we entered into an agreement with Abu Dhabi Shipbuilders to provide waterjet services in the Middle East.

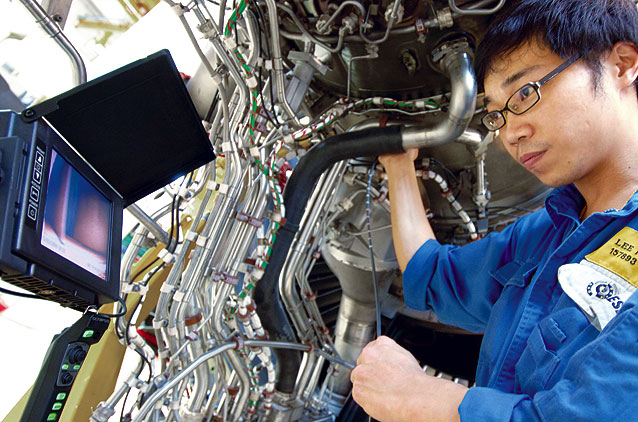

During 2008, we continued to invest in our civil aerospace service network, with extensions to both Singapore Aero Engine Services Limited (SAESL) and Hong Kong Aero Engine Services Limited (HAESL) under construction.

This capacity will come on stream in 2009 and 2011 respectively and is being funded without recourse to the joint venture shareholders. In its first full year of operation, the overhaul facility we have established with Lufthansa, N3, has made steady progress, successfully introducing Trent 700 capability and expanding its customer base. Our field support capability has also been enhanced with the opening of our eighth On-Wing Care centre, in Brazil, and we are developing capability in the UAE in conjunction with Mubadala Development Corporation. On-Wing Care services were provided for over 3,000 engines across the year.

We have continued to expand our services provision with the successful deployment of our Electronic Flight Bag (EFB), now in its third year. The EFB provides, among other applications, a key data acquisition capability to optimise overall aircraft and fleet fuel usage.

The TotalCare model encourages an integrated approach, which means we work closely with our customers to optimise the operation of their assets while carefully managing costs. We conduct in-service monitoring for over 8,300 engines worldwide, providing engine health monitoring and data analysis services in conjunction with our expanded Operations Centres. This enables real-time data acquisition and analysis to maximise operational performance for our customers in parallel with optimising support costs.

We are also increasing the focus on overhaul costs, reorganising our component repair activities during the year to establish Global Repair Services. This organisation takes a strategic approach to repair development and is investing in advanced repair processes.

Contract highlights for the year included agreements with US Airways to support its RB211-535 fleet with a TotalCare package and a similar contract with IAE for its V2500 fleet. TotalCare support arrangements now cover 57 per cent of the civil aerospace fleet. In defence aerospace we competed for and successfully retained, the F405 US Navy contract, which we have been executing for the past five years, the new contract being for a further year with four one year extension options. Also notable were a number of helicopter contracts including a £258 million award from the UK MoD to support Gnome engines. In the energy business, ten long-term service agreements were won with a total value of £160 million. We expect to agree a further ten energy contracts covering 50 new gas turbine units that will be installed during 2009, taking the number of packages under long-term service agreements to over 250, or around 20 per cent of the fleet.

The upgrade and standardisation of our IT systems to support the services business continued and underpinned our expanded-capability Operations Centre, opened in the UK during 2008. We have also defined a suite of integrated Service Life Cycle Management processes and supporting IT tools that we are rolling out Group-wide in a multi-year programme. The highlight for the year was a flawless implementation of SAP at HAESL where the site achieved near record output in the month the system went live.

We remain confident that our service model is aligned with our customers’ interests, encouraging us to focus on maximising the effectiveness of their assets. This alignment and focus drive the investment in capability and improved delivery that is the hallmark of our services business.